Are you ready to buy a home, but struggling to save for the down payment? In this blog post, I am going to break down how to save money for a house in 6 months. We’ve also got a FREE printable savings tracker to help you get started on your journey toward saving for a house.

Now, I will say that doing this is not for the faint of heart. To buy a home, you will need a fairly significant amount of money saved up, and it can be difficult to do that in such a short amount of time. However, it is not impossible to do with some simple lifestyle changes and strategic financial planning.

So, if you’re ready to ditch your rent payment and buy a house, then let’s jump right in!

This post may contain affiliate links which means that I may receive compensation at no extra cost to you if you make a purchase from a link found on my site. Please review my privacy policy for further details. As an Amazon Associate, I earn from qualifying purchases. Thank you for your support in allowing this site to continue!

What is the minimum down payment that I need to buy a house?

The answer to this question will depend on the country you live in, but for the United States, the minimum downpayment for a mortgage is 5% of the total purchase price of the home. So you will need to save at least that much.

However, it is worth noting that any down payment of less than 20% requires mortgage insurance which is extremely costly. In this table, I break down the added cost of mortgage insurance on a $300,000 home purchase price. To calculate what this will cost for the price range you are shopping in, go here for access to the calculator.

| Asking Price – $300,00 | 5% Downpayment | 10% Downpayment | 15% Downpayment | 20% Downpayment |

|---|---|---|---|---|

| Downpayment Amount | $15,000 | $30,000 | $45,000 | $60,000 |

| Estimated Insurance Cost | $11,400 | $8,370 | $7,140 | $0 |

| Total Mortgage | $296,400 | $278,370 | $262,140 | $240,000 |

*Please note that these prices are just an estimation to give you an idea of what this could potentially cost you. Always talk to your local mortgage specialist for more accurate numbers.

In order to avoid having to pay that mortgage insurance, you will need to put down at least 20% of the purchase price of your home. Here I have broken down how much you will need to save for a few different purchase prices.

| Home Purchase Price | Down Payment Needed (20%) |

|---|---|

| $100,000 | $20,000 |

| $150,000 | $30,000 |

| $200,000 | $40,000 |

| $250,000 | $50,000 |

| $300,000 | $60,000 |

| $350,000 | $70,000 |

| $400,000 | $80,000 |

| $450,000 | $90,000 |

How much money should I save before buying a house?

In addition to having a downpayment saved up for the purchase price of your home, you should ideally have an additional nest egg saved up. This gives you a buffer in case of any unforeseen circumstances.

Additionally, there are always more costs to buying a house than one might initially plan for. And as a brand-new homeowner, you should always be prepared for the unexpected. Here are some potential costs that you might not have thought of:

- Closing costs

- Furniture and appliances

- Moving costs and storage fees

- Landscaping and exterior maintenance costs

- Interior decorating and painting costs

It is our recommendation that you save an additional 3-5% to cover these additional fees and still have some money leftover to save for unforeseen circumstances such as home repairs, upgrades, etc.

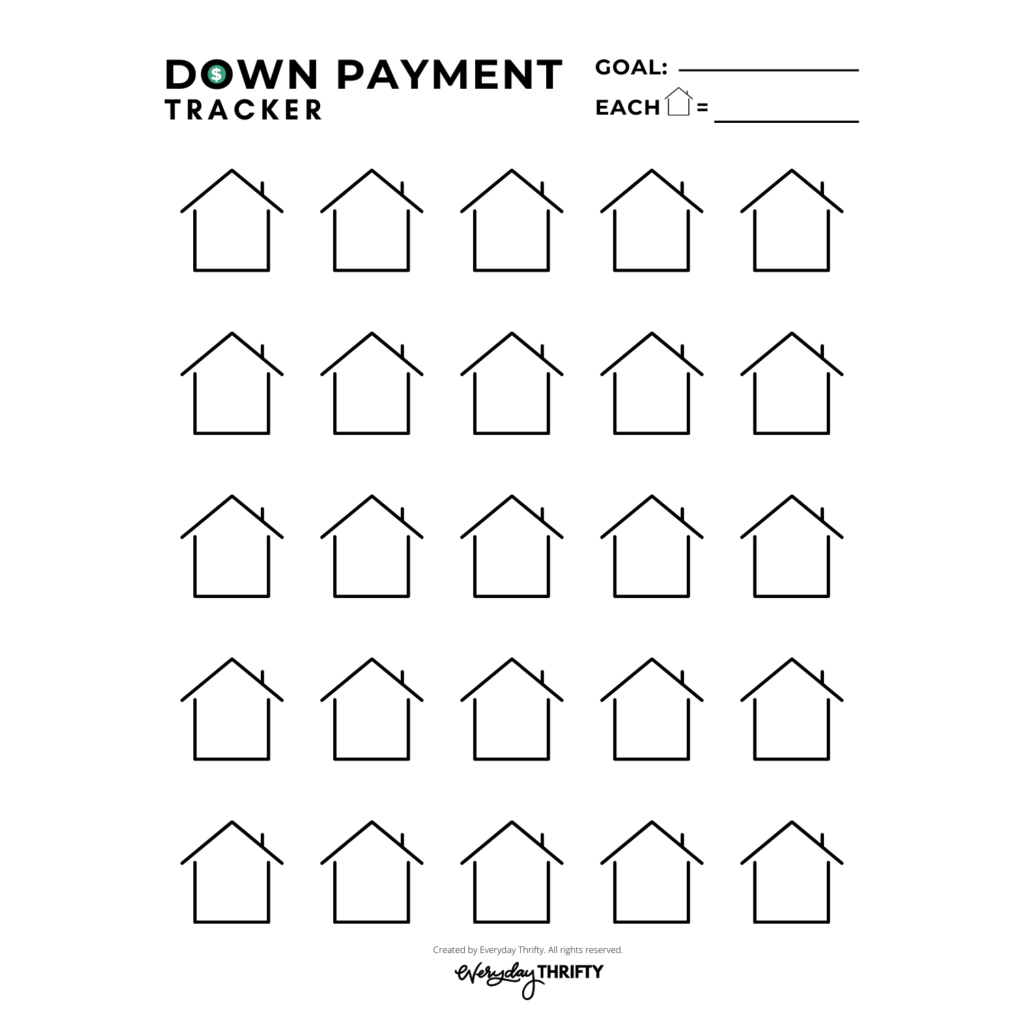

Start tracking your progress with our FREE printable savings tracker here!

Creating A Savings Plan

Once you have calculated how much money you need to save, it is time to create your savings plan. As previously mentioned, this is a very large sum of money to save at once, so it is important that you take the time now to create a detailed savings plan.

To create this plan, you could take the total amount you need to save for your home, and divide that by 6 months. So if you are looking to save $60,000, that would mean you need to save $10,000 each month.

When creating your savings plan, you will also need to factor in any money you can use that you may not necessarily need to save. This could include utilizing a first-time home buyer plan, withdrawing from TFSA’s, etc. I cover this further down in the blog post, but it can be helpful to talk to a mortgage specialist once you start saving for the purchase of your home to know if you qualify for any of these things.

8 Ways To Save Money For Your Down Payment

Once you know how much money you need to save every month, it’s time to look at ways you can actually save the money. To get started, here are a few methods that you could consider.

1. Set A Budget

Budgets are an extremely useful tool to help you understand and track your spending. Once you understand where your money is going, you can begin to cut back on unnecessary expenses.

There are numerous ways to set a budget, but one of the most common methods is the 50/30/20 rule. Under this method, you would divide your income as follows:

50% towards essentials (bills, groceries, etc.)

30% towards wants (clothes, travel, entertainment, etc.)

20% toward savings

If you want help with your budget, check out this guided budget notebook here!

2. Cut Expenses

Once you have your budget set, you can then start to look for ways to save money. Some expenses may be obvious to cut out like eating out less or cutting back on your entertainment spending. However, there are many things you can do to cut back your expenses. Here are some ideas you can consider:

- Cut back on your subscriptions – Do you really need that gym membership or Netflix subscription? Go through your credit card statements and see what subscriptions you could cut back on.

- Reduce spending on groceries – How much food do you waste every week? How many complex meals are you cooking in a week? Try to find some budget-friendly meals that can help you reduce your grocery spending.

- Buy second-hand – If you find that you need something during this time, consider buying the items second-hand. This can include clothes, furniture, etc.

3. Pay Off Debt

One of the best ways to save money is to pay off any high-interest debt that you may have. This includes things like credit card debt, lines of credit, etc. The interest you are paying on this debt is essentially throwing money away. So, by paying off those debts, you can free up more money each month to save for the down payment on your home. Read about how we paid off almost $68K in debt here.

4. Use Found Money

When saving for the down payment of your home, you should do your best to use any found money towards that. This could include a tax refund, a work bonus, or even just money you find by accident on the street or in your couch cushions. Doing this can help you reach your goal much faster.

5. Get A Side Hustle

Even after cutting down your expenses, you may still find that there isn’t enough money to save to reach your goal of saving the down payment for your home in 6 months. If this is the case for you, consider getting a side hustle.

There are so many different types of side hustles you could try like becoming a mystery shopper, driving for Uber, starting a blog, freelancing, and more. For a complete list of side hustle ideas, go here.

6. Sell Unused Items

We all have things lying around the house that we never use. So, instead of letting them sit there and collect dust, why not sell them? You can declutter your home and earn some extra cash at the same time.

If you have just one or two things, you can sell them on local marketplaces or Facebook groups. If you have numerous things you can sell, consider having a garage sale.

7. Collect Change

This tip may seem small, but trust me, over time, all your loose change adds up very quickly. Instead of buying that coffee or having a purse full of change, consider collecting it in a jar. You can count it every month to see how much you have added to the down payment of your home.

8. Track Your Progress

One of the most motivating ways to achieve any goal is to track your progress. This is especially true when saving for a house. We’ve created a free printable savings tracker that will help you work toward your down payment goal. Just print it off, calculate your specific goals on the sheet, and start saving up for that house!

3 Additional Options To Help With The Down Payment Of Your Home

In addition to the cost-saving methods listed above, there are other things you can do to help with the down payment of your home.

1. Getting A First Time Home Buyers Loan

If you’re a first-time home buyer, you may be able to qualify for a first-time home buyer’s loan. These loans are typically offered with more favorable terms than a traditional mortgage, such as a lower down payment or interest rate.

2. Using An RRSP Loan

Another option available to some home buyers is to use an RRSP loan. With this option, you can borrow up to $35,000 from your RRSP account to put towards a down payment. The great thing about this option is that the money you borrowed will be paid back into your RRSP over the next 15 years, meaning you’ll essentially be paying yourself back with interest.

3. Withdraw From Your Tax-Free Savings Account

If you have a Tax-Free Savings Account (TFSA), you may be able to withdraw funds from it to put towards a down payment. The TFSA is a great way to save money because the money you contribute grows tax-free. So, if you have been contributing to a TFSA for a while, you may have a decent amount of money saved up that you can use for your down payment.

With all of these options, be sure to talk to a mortgage specialist near you to determine which options you are eligible for, and which will be the best option for your individual situation.

Utilizing one of these options can help you significantly when saving up the down payment for your home.

Where Should I Keep My Money When Saving For A House?

When saving for a house, it’s important to choose the right type of account to ensure your money is working hard for you.

One option you have is a high-interest savings account. With this type of account, you’ll earn interest on the money you have deposited. This can help your money grow faster.

Another option is a Tax-Free Savings Account (TFSA). As the name suggests, this account allows you to save money tax-free.

Which type of account you choose will depend on your individual circumstances. Be sure to talk to a financial advisor to determine which option will be best for your circumstances.

How Do I Save For A Downpayment In 6 Months On A Low Income?

If you’re on a low income, there are still a number of ways you can save for a down payment.

One option is to get a part-time job or start a side hustle. This can help you boost your income and reach your savings goal faster.

Another option is to cut back more significantly on your expenses. This could include cutting back on your rent and living in a smaller place, getting a roommate, selling your car, using public transportation, etc.

To find more ideas on how you can save money on a low income, go here.

Saving for a house can seem like a daunting task, but if you break it down and create a plan, it is definitely achievable.

And remember, it may not be fun and games while you are doing it, but once you are in your home, you won’t regret it!

Read Next:

How To Live Below Your Means – The Secret To Long-Term Wealth

How To Stop Buying Stuff – 7+ Simple Ways That Actually Work

Most Effective Ways To Save Money On A Low Income

Leave a Reply