This past year may have possibly knocked your financial goals off track, but that’s no reason to not jump back on the horse and take the 2025 money challenge. For this money challenge, we’ve broken everything down into 52 practical tasks.

Rather than focusing on a specific savings goal, we wanted to cover a variety of money-related tasks. Some of the tasks on our money challenge will help you save money. Others are for reducing spending or investing for retirement.

The key is to jump into this with two feet, stay committed, and get plugged into a community of like-minded people. Let’s plan on making next year productive, no matter what life may throw at us. It’s time to take to get geared up and make 2025 an amazing year.

To help keep you on track, we also have a FREE 52 Week Money Challenge printable!

This post may contain affiliate links which means that I may receive compensation at no extra cost to you if you make a purchase from a link found on my site. Please review my privacy policy for further details. As an Amazon Associate, I earn from qualifying purchases. Thank you for your support in allowing this site to continue!

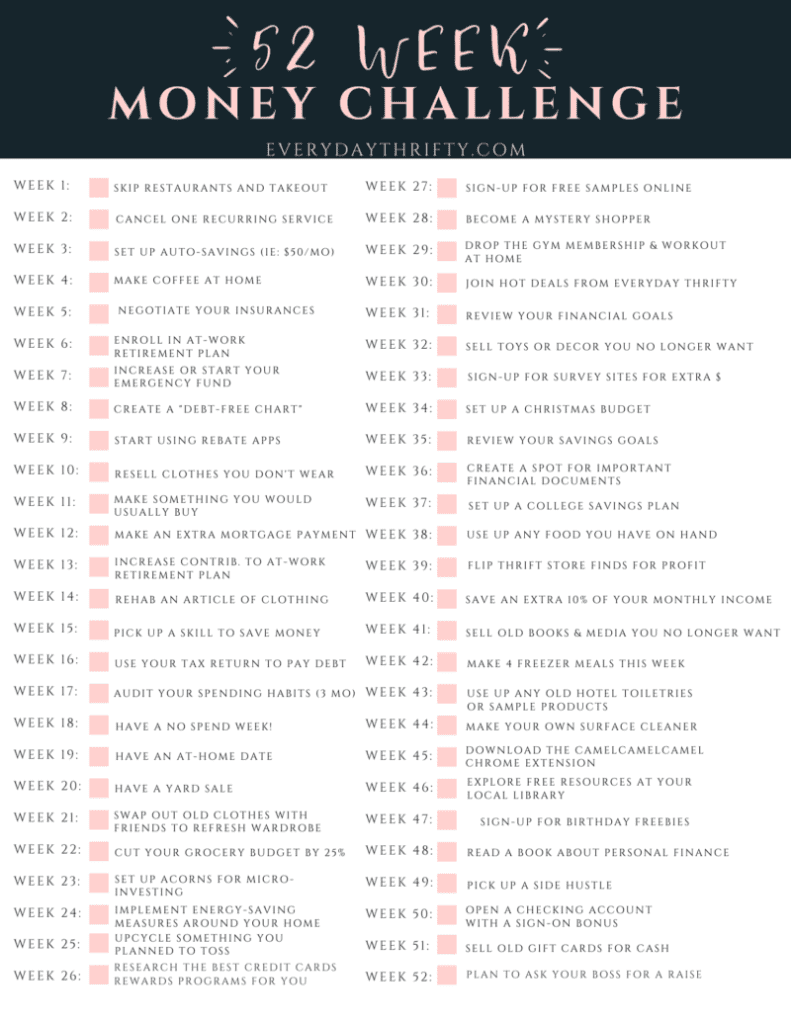

52 Week Money Challenge for 2025

WEEK 1: Skip restaurants and takeout this week. All meals come from what you purchased at the grocery store!

WEEK 2: Find one service or subscription you pay for and cancel it.

WEEK 3: Set up a monthly savings amount to auto-draft from checking into savings (eg: $25 month, $100 month, etc)

WEEK 4: Make coffee at home instead of going out for it.

WEEK 5: Negotiate your home, auto, life, and health insurance to make sure you’re getting the best rates.

WEEK 6: If you have an employer-sponsored retirement plan, make sure that you’re enrolled and, at least, contributing up to the match.

WEEK 7: Increase your emergency fund or start one for the first time.

WEEK 8: Create a “debt-free chart” and post it on the fridge to stay motivated.

WEEK 9: Download and start using rebate apps.

WEEK 10: Look through your clothes and resell items you no longer wear.

WEEK 11: Make something you would usually buy.

WEEK 12: Make one extra mortgage payment. If you don’t own a home, make an extra payment towards another debt.

WEEK 13: Increase your contributions to your work retirement plan. If you don’t have one, set up a RothIRA, and start contributing to it.

WEEK 14: Refresh or upcycle an old article of clothing rather than buying new.

WEEK 15: Pick up a skill (like gardening) that can save you money.

WEEK 16: Use your tax return to pay off debt or add to savings.

WEEK 17: Do an audit of your spending habits for the past 3 months.

WEEK 18: Have a No Spend Week!

WEEK 19: Have an at-home date instead of going out.

WEEK 20: Clean out the garage or attic for a yard sale.

WEEK 21: Swap out old clothes with friends to refresh your wardrobe.

WEEK 22: Challenge yourself to cut your grocery budget by 25% this week.

WEEK 23: Set up Acorns for micro-investing.

WEEK 24: Research and implement energy-saving measures around the home.

WEEK 25: Upcycle something you were planning on throwing away.

WEEK 26: Research credit cards to make sure you’re getting the best deal for points.

WEEK 27: Sign-up for free samples online.

WEEK 28: Sign-up to be a Mystery Shopper and schedule your first shop!

WEEK 29: Drop the gym membership and do a workout routine at home instead.

WEEK 30: Join Hot Deals from Everyday Thrifty to get amazing deals!

WEEK 31: Review your financial goals.

WEEK 32: Look through your child’s toys (and/or home decor pieces) and sell what you no longer want.

WEEK 33: Sign-up for survey sites and start making money online.

WEEK 34: Set up a Christmas budget and stick with it.

WEEK 35: Review your savings goals. Are you saving enough for retirement, a down payment on a house, etc?

WEEK 36: Set up a designated location for important financial documents and passwords in the event of an emergency.

WEEK 37: Look into setting up a 529 or other college savings plan for your children.

WEEK 38: Use up any food you have on hand this week in the pantry or freezer before you shop for more groceries.

WEEK 39: Go to a thrift store and shop for any items that you can flip for profit.

WEEK 40: Put an extra 10% of your monthly income into savings this week.

WEEK 41: Look through old books, movies, and CDs and sell what you no longer want.

WEEK 42: Make 4 freezer meals this week to prep for future meals.

WEEK 43: Use up any old hotel toiletries or sample products instead of buying new.

WEEK 44: Make your own homemade surface cleaner.

WEEK 45: Download the CamelCamelCamel Chrome extension to make sure you always save the most on Amazon purchases.

WEEK 46: Explore free resources at your local library. In addition to books, you can often check out music, movies, audiobooks, and more.

WEEK 47: Sign up for TONS of birthday freebies!

WEEK 48: Read a book about personal finance.

WEEK 49: Pick up a side hustle.

WEEK 50: Open a checking account with a sign-on bonus for extra cash.

WEEK 51: Sell old gift cards on sites like Raise that you don’t think you’ll use.

WEEK 52: Document your achievements at work and consider asking your boss for a raise.

Don’t forget to print off the FREE 2025 Money Challenge Printable so you can start checking off your success each week!

We’re so excited for you that you’re intentionally taking the steps to get your finances in order this year. And, if you’re looking for additional ways to jumpstart your savings fast, hop on over and check out How To Save $5000 in 3 Months: The Ultimate Checklist and 19+ Simple Ways To Make $200 Fast.

Leave a Reply